The App Revolution: Personalized Offers in Retail

The use of retail apps like Mein dm or Lidl Plus continues to grow rapidly. What used to be a loyalty card in your wallet or a paper coupon has now moved entirely into apps. More and more customers are using these digital applications as central companions when shopping.#

The Shift to a Digital Offer Landscape#

The biggest change comes from increasing personalization: While coupons like "20% off almonds" used to be distributed in paper form to everyone, today different users receive different offers – such as 30% off almonds, 10% off pistachios, or discounts on their favorite chips. These coupons are delivered using artificial intelligence that analyzes individual shopping behavior and delivers the offers that appear most relevant to each person.

Additionally, retailers are promoting the use of their apps through exclusive features such as sweepstakes, bonus programs, or app-only offers. The Lidl Plus app demonstrates with regular promotions how gamification can contribute to customer loyalty. The launch of the new REWE Bonus or Netto Plus app also illustrates how strong the focus on app-based customer interaction has become.

At the same time, these developments open up new marketing opportunities for manufacturers: Retail apps are increasingly evolving into retail media platforms where brands can target placements and promotions. The combination of direct access to target audiences and data-driven personalization creates new ways of brand communication.

Personalization as a Strategic Challenge#

The downside of this development: Total lack of transparency. No one knows exactly what is being displayed in other apps anymore. Manufacturers ask themselves: What coupons is my retail partner – or my competitor – advertising? How individualized are the discounts? And how successful are the campaigns?

This new offer logic is no longer visible in stores or in flyers – it is algorithmic, individual, and dynamic. This creates a structural information deficit that can only be addressed through new forms of measurement and analysis.

How Personalized Are App Offers in 2025?#

To shed light on this, Murmuras has deployed new on-screen technology on users' phones that passively captures all retail app content in the background. The 3,000 users have actively consented and receive a reward. Essentially a digital consumer panel for retailer apps, particularly to research coupons, retail media, and other app promotions.

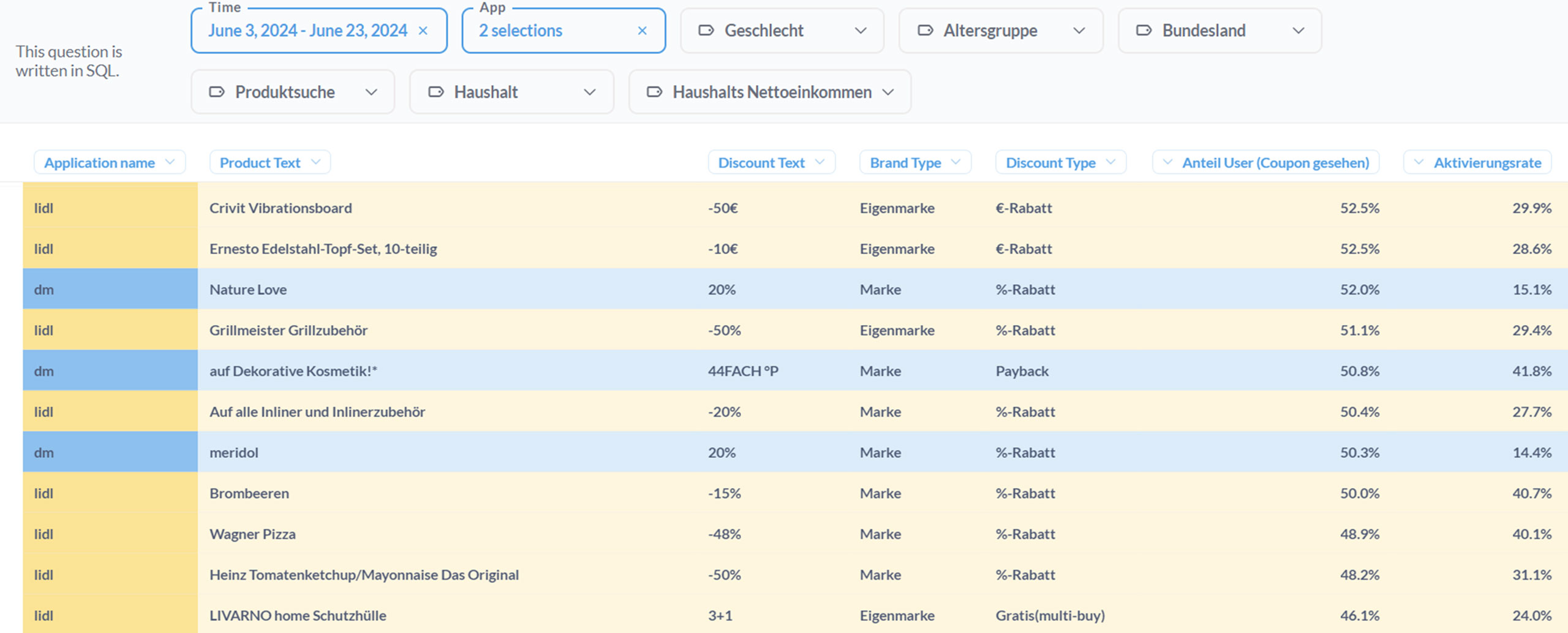

In the following example, tracked coupons were provided with user reach (proportion seen) and activation rate. The degree of personalization can be derived from the reach. The fewer users who receive/see a coupon, the higher the degree of personalization.

Figure 1: Example coupons with reach (proportion seen) & activation rate

To classify the degree of personalization, the following categories were established:

• Coupons with reach >20% = Broad distribution

• Coupons with reach 5% - 20% = Specific target distribution

• Coupons with reach 1% - <5% = Partially personalized

• Coupons with reach <1% = Personalized

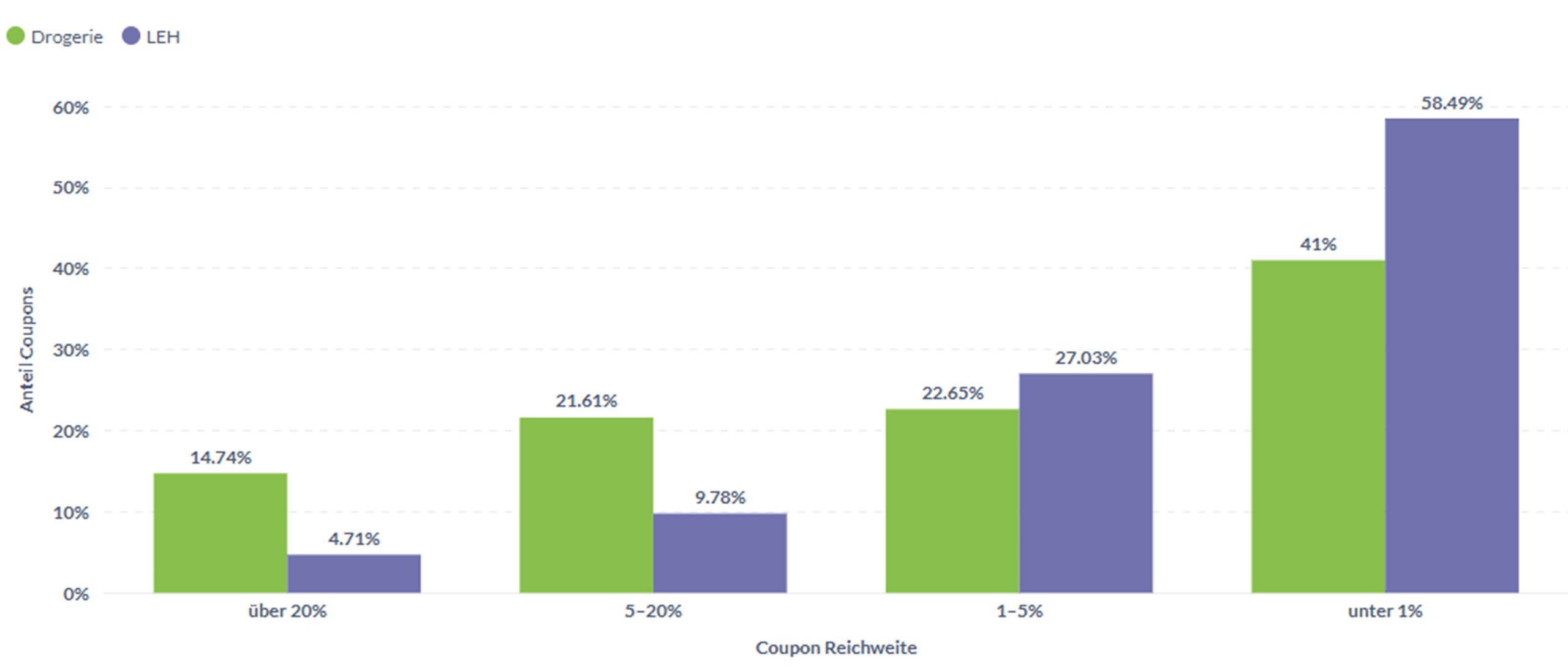

The following graphic shows how coupons distributed in retail apps are divided by reach – and highlights differences between drugstores and grocery retail. Coupons in the retailer apps Lidl Plus, Kaufland, REWE, PENNY, EDEKA, Rossmann, Mein dm, and Müller were examined.

Figure 2: Degree of personalization in grocery retail & drugstores (Apps: Lidl Plus, Kaufland, REWE, PENNY, EDEKA, Rossmann, Mein dm, Müller, n = 3,000 users, t = Jan-Mar 2025)

Drugstores disproportionately rely on coupons with medium to high reach, in contrast to grocery retail, where coupons with low reach dominate. The trend toward personalization continues to increase, especially in grocery retail. This is also evident over time: From January to March 2025, the share of coupons with less than 1% reach in grocery retail apps increased by almost 10 percent. However, there are also significant differences depending on the app.

Are Personalized App Offers Also More Successful?#

Are personalized coupons more successful than broadly distributed ones? This question is obvious – but cannot be answered universally. On one hand, coupon types differ greatly in their attractiveness and objectives; on the other hand, there are significant differences between the various retailer apps.

A widely available free coupon, for example, is hardly comparable in its effect to a personalized 10% discount on a specific brand. To make reliable statements about the effectiveness of different distribution strategies, a differentiated analysis by product category and app is therefore required.

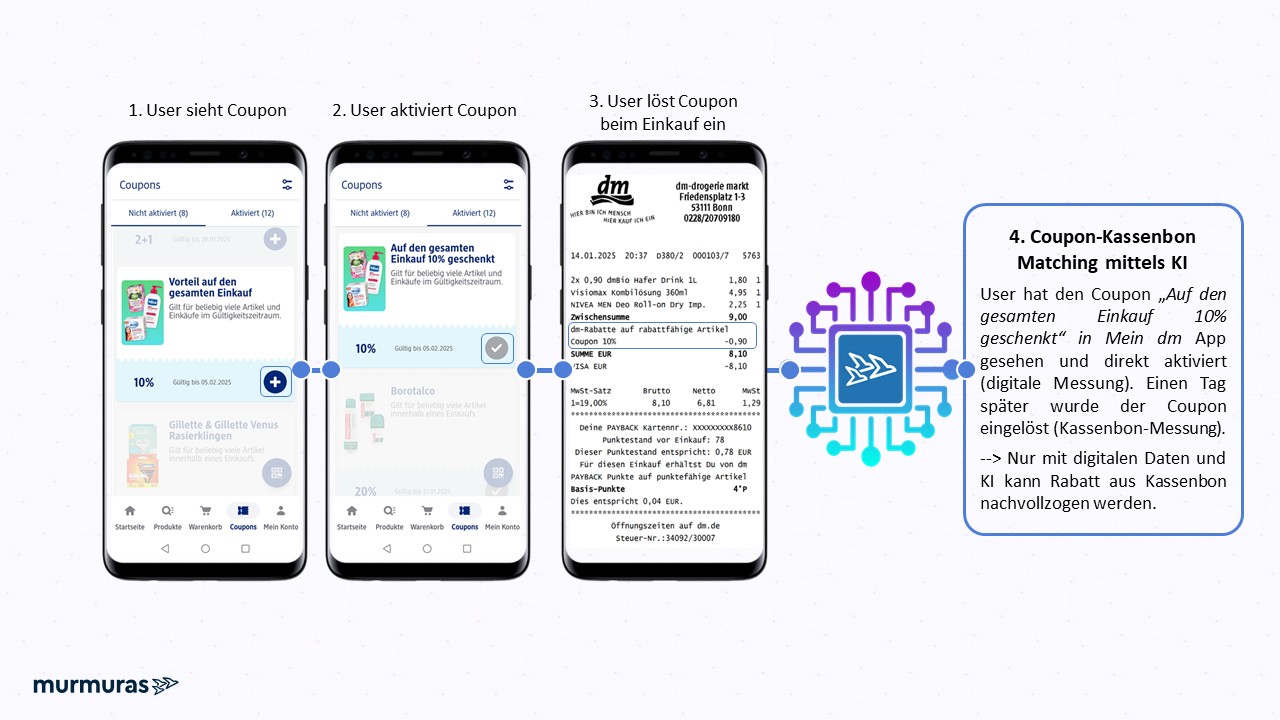

But how do you measure the success of personalized coupons at all? In addition to activation in the app, actual redemption in the store is crucial. To capture this, Murmuras asked approximately 3,000 digitally tracked participants to also scan their paper receipts.

Only by combining the app data with the receipt information does a complete picture emerge: Using AI, the discount text from the app coupon is matched with the discount lines on the receipt. For the first time, this allows automated tracking across all apps to determine which discounts were redeemed by whom – and which were not.

Figure 3: Matching the digital app coupon with the receipt

Conclusion: Retail Apps as the New Media and Control Center#

Retail apps now play a central role in the marketing mix. With the increasing personalization of coupons and offers, however, not only the logic of offer management is changing, but also the way success is measured and campaigns are managed.

For retailers and brand manufacturers, this means: Anyone who wants to use couponing in apps strategically must understand what is actually happening – and how consumers respond individually. Only with a new understanding of success – through activation AND redemption – can campaigns be meaningfully evaluated. This is exactly where Murmuras comes in with its combination of on-screen tracking and receipt matching. A data-driven approach creates decision-making foundations for retailers and manufacturers – both for operational campaign optimization and strategic competitive analysis.

About the author

Qais Kasem

Related Posts

Murmuras' new consumer panel provides insights into retail app discounts

Murmuras is honored with the 2024 Science Award