Easter 2022 - Advertising and Shopping in Smartphone Apps

In addition to painted eggs and chocolate bunnies, Germans spent their 2022 Easter season using smartphone apps. We analyzed in-app behavior data, taking a special look at ads seen and shopping behavior. The analysis is based on real in-app smartphone usage data from everyday life - without any questionnaires or cookies.

In total, the in-app behavior of 1359 smartphone owners was recorded and analyzed over a period from March 1 to April 19, 2021. 649 participants used the Facebook app, 640 the Instagram app, and 516 the Amazon shopping app. The subjects participated in the study in a GDPR-compliant manner.

Key Takeaways#

- Disney+ reached the most users during Easter - 41% of users saw ads on Facebook, 40% on Instagram.

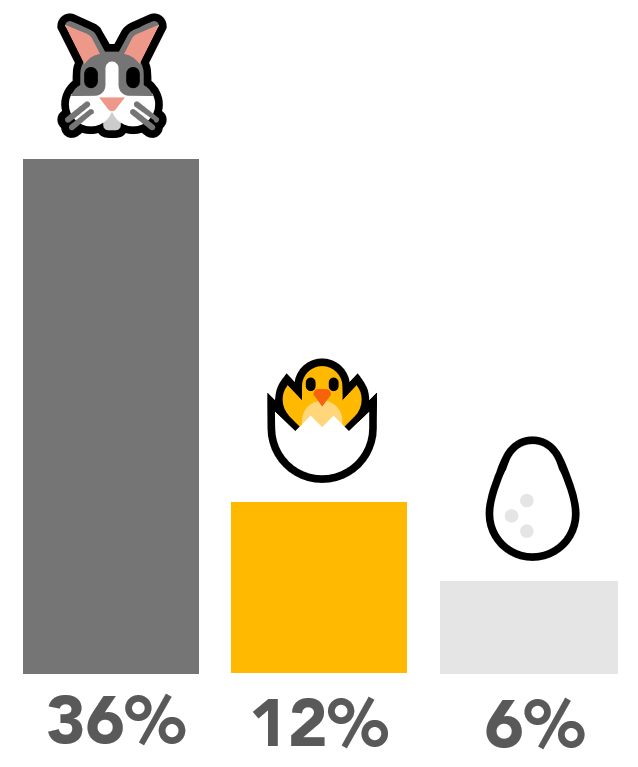

- The Easter bunny 🐰 is the top Easter emoji - It's included in 36% of all Easter ads, with chick 🐣 (12%) and egg 🥚(6%) in 2nd and 3rd place.

- Products in the Kitchen, Household & Home category are clicked the most on Amazon with 9.9%, the most popular products here are Deco and Craft items.

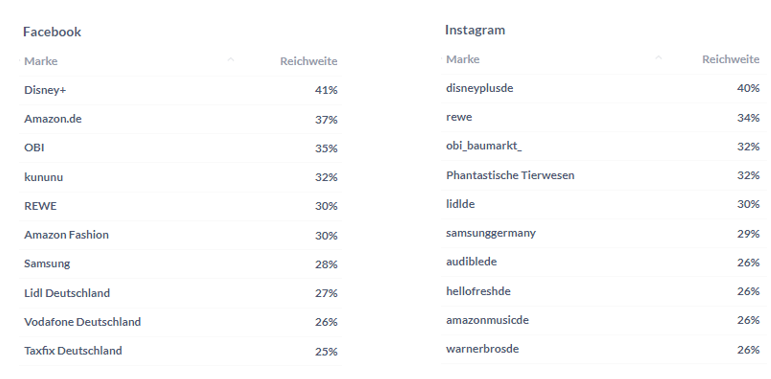

Brands with the largest advertising range#

The lists of the top 10 by advertising range for Facebook and Instagram during the Easter period overlap significantly. Brands such as Disney+, Amazon, OBI, REWE, Lidl and Samsung advertise heavily on both platforms, reaching large shares of users. Disney+ reached the most users during the Easter period - 41% of users saw ads on Facebook, 40% on Instagram. This is followed on Facebook by Amazon (37%) and OBI (35%), and on Instagram by REWE (34%) and again OBI (32%).

Also noticeable here is the reach of the newly released film of the series "Fantastic Beasts". This is advertised on Instagram independently of the developer studio Warner Bros via its own account and reaches 32% of users with ads, while Warner Bros only has a reach of 26%.

Easter advertising#

Some companies are picking up Easter in their campaigns, but less than perhaps expected. In the week leading up to Easter Sunday (10-17 April), 5.9% of brands themed Easter in their ads on Facebook and Instagram. Matching Easter emojis were not to be missed in the process. The Easter bunny 🐰 is the clear winner and was hidden in 36% of the Easter ads. It is followed by the chick 🐣 and the Easter egg 🥚.

In addition to an Easter reference in the form of emojis or Easter terms, the main focus was on one thing - Easter deals. Brands used the Easter period to attract customers with special promotions and price cuts. Compared to the period before Easter, the number of ads containing "deal" increased by 47% from 1036 to 1522. A similar effect can be observed for ads containing the terms "offer" (increase by 39% to 3328) and "discount" (increase by 32% to 3299). However, the total number of ads has barely changed. Each user sees ~13 ads per day, 5 of which are new on average, about the same as before the Easter season. This is also evident at other seasonal events such as Black Week or Christmas - Meta does not play more ads, but increases the prices of ad slots in order not to affect the user experience.

Easter Shopping in the Amazon App#

What would Easter be without fitting decoration? This is often ordered on Amazon - With 9.9%, products in the category Kitchen, Household & Home are clicked more than any other category, the most popular products here are decorative and craft items. In the period before Easter, this category was still in second place with 7.6% of all clicks behind clothing. This represents a strong increase of 2.3%. More clicks were also observed for the categories Electronics & Photo (+0.7%) and Toys (+0.5%). A look at the searches with the term "Easter" again shows the particular demand for decorative and craft items. However, the product that was searched for the most during the Easter period is not an Easter item and yet it can be attributed to current events - sunflower oil (2.2% of all users).

The analysis of Easter 2022 shows that many brands are adapting their advertising strategies and campaigns seasonally to provide users with relevant offers. The influence of Easter is also reflected in user behavior, especially in searched and clicked products.

If you are interested in details and more information from the study results, feel free to contact us. More details can be found here.

About the author

Jeremy Kleindienst

Related Posts

Murmuras launches new measurement for GenAI usage behavior

The App Revolution: Personalized Offers in Retail